A bit on the fed - teaser | Data Behind Fintech's wild 22' | Banks wanna take on Apple & co |Genesis 🤝 bankruptcy | Startups that caught my eye

Habari (that’s hello in Swahili) folks 👋🏾🙇

Let’s get right into it cos this week, as ever there are hella interesting fintech stories…

But I want to start with a little excerpt from tomorrow’s newsletter. Yes I’ll do one tomorrow all about the Federal Reserve. But I felt having that in today’s one is overkill. Ain’t nobody got time to read all that rambling.

The Federal Reserve's Folly: The Magic Money Tree That Broke The Economy

“Why did the Federal Reserve cross the road? To get to the other side of the street and print more money!”

So last week I said that the Federal Reserve was perhaps the most authoritarian institution in the authoritarian institution in the west. Unpacking that is going to take a bit of effort but I’ll give it ago…

My starting point for this is to go a book written by French economist Thomas Piketty back in 2013, "Capital in the Twenty-First Century". The book is remarkable in that it was exceptionally received, becoming a global bestseller. A book on econ, who'd have thunk it?

It would be difficult to summarize Piketty's 700-page book, however, the central idea — which he supports with historical analysis and data — is that the gap between the wealthy and the rest is widening due to the fact that the rate at which wealth grows (through investments and other forms of capital) is consistently higher than the rate of economic growth.

That is to say that rate at which investors and business earn a return on their capital investments (think of stocks and houses prices) is higher than the rate of overall economic growth. You often here that indices like the S&P500 return 10% a year on average, for example, while economic growth typically is 1% or 2%.

It means that the rate at which investors and businesses are able to earn a return on their capital investments (such as stocks, bonds, or real estate) is consistently higher than the rate of overall economic growth in developed countries.

One way of understanding this is through the notion of asset price inflation. Now asset price inflation is different from the inflation we’re experiencing right now - price inflation. The latter is focused on typical consumable goods - food and energy and the like. Now obviously if returns on capital are higher than economic growth what that means is people who have assets will see their wealth go up faster than those who don’t have assets and are primarily in the business of earning a wage.

And we don’t even need deep historical analysis to know that this is true: Just look at house prices v. wages.

So you’re asking…’ what does the Fed have to do with this?’

I’ll break that down tomorrow.

Data: “22 Was Wild, Indeed!” 😬

CB Insight’s super insightful State of Fintech 2022 report has just been released and it’s a treasure trove of data, if your a nerd like me that is.

Here are some of the key points:

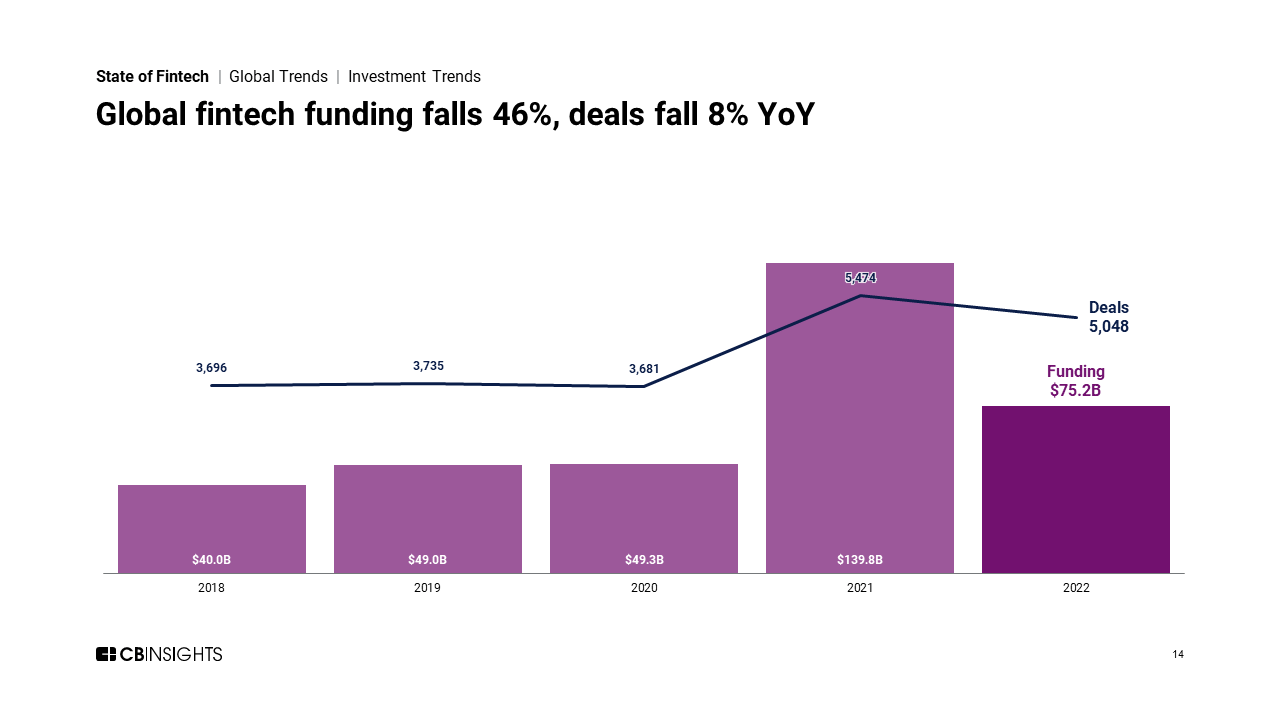

📉 Funding crashes

Funding was down a staggering 46% year-over-year with $75.2 billion raised in 2022 compared to the almost $140 billion that was scooped up by fintechs’ in 2021. Ouch!

Surprisingly, while fintech deal volume fell it did so marginally with an 8% decline globally year-over-year to 5,048 in 2022. That suggests even despite the turmoil there remained ample appetite for deal-making, but likely at smaller check sizes.

Astonishingly though, despite the almost 50% collapse in funding volume, the 2022 total is comfortably above any other year bar 2021.

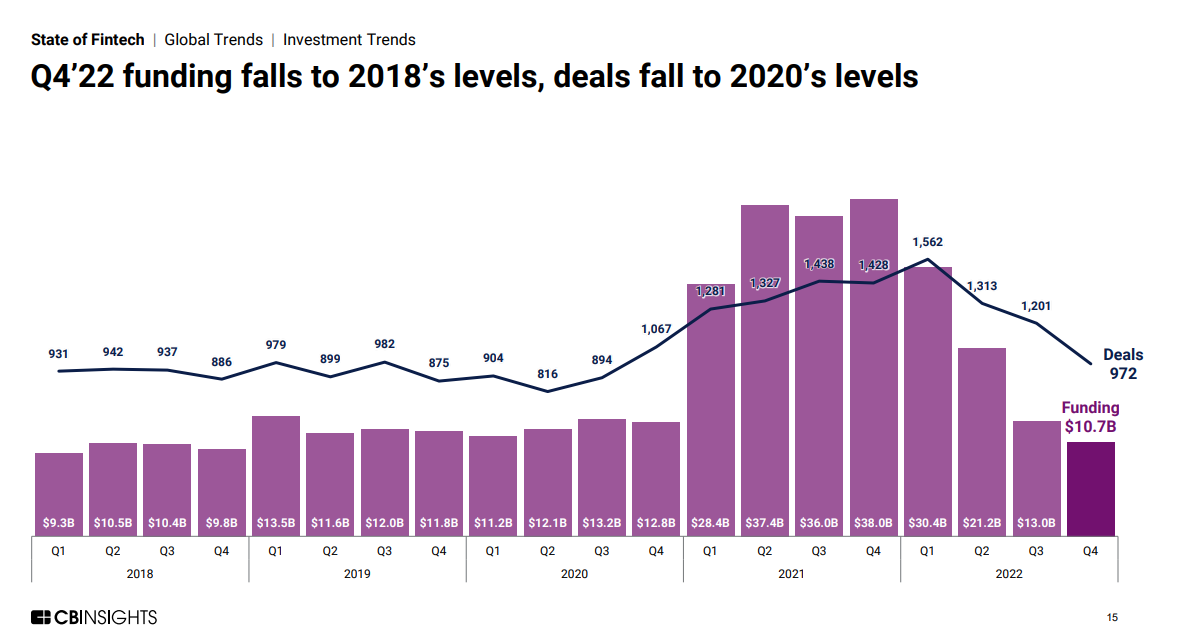

But here’s where it gets interesting: The real damage was done in the second half of last year and especially in Q4 — as the hopes of transitory inflation were quickly put to bed and interest rates continued to skyrocket. All told, only $10.7 billion of investment dollars went towards fintech startups in the fourth quarter.

And that’s worrying: The momentum, as you can see below, is pretty clear. Funding for Q4 was the lowest since the days when people actually used Google+, aka 2018. That suggests the funding pain might be here for a good while.

You might ask, ‘how painful can it really and truly be if Q4 funding is on par, at least on average, with pre-2021 levels?’

The problem lies with the way most VC-backed companies operate. Typically VCs place certain criteria, and more often than not these criteria revolve around how fast these companies spend their latest raise. They want them to use it fast to expand and scale. And in boom years this can work out well — the startup’s various metrics go up, allowing them to raise even more money down the line at a higher valuation.

The problem comes when suddenly that flow of capital becomes harder to get or even dries up entirely. Around 30% of startups fail because they run out of money. Now imagine you’ve raised a shit tonne of capital during 2021, you operate with that worldview in front of you. When the money stops immediately though, your burn rate doesn’t. After all, you’ve got employees, office space, suppliers, and more — AKA fixed costs.

And that’s where the pain comes in. These startups are built with those good times in mind. Scaling back costs for the dark days isn’t easy or quick.

🌍Africa shining

Africa was the only major region to see deals increase compared to 2021, with a record 227 deals in 2022, a 25% increase year-over-year. A staggering 89% of 2022 deals in Africa were early-stage, which is a five-year high for the continent and the highest among all other regions.

The caveat: Despite the increase in deals, funding on the continent remained lower than 2021 levels. This supports a thesis I’ve had for a little while now — probs last four five months:

👉🏾Investing in developing markets comes with a heavy dose of risk. But 2022 has kinda began to flip that on its head. Mature markets are heavily saturated: The influx of easy venture capital in recent times has resulted in the proliferation of copycat companies, with funding being secured as soon as a profitable niche is identified.

👉🏾As a result, the risk profile differential, between investing in African startups and startups in mature markets like the US increasingly tightens. That’s to say the current conditions have made investing in traditional fintech markets significantly riskier, and inversely ecosystems like Africa become more attractive.

👉🏾Crucially though this doesn’t necessarily change the risk profile of investing in African companies significantly. But rather, looks less risky in comparison. So more VCs are willing to dip their toes in that market. That 89% of deals were in early-stage supports this idea.

🦄 Unicorns outta sight, insurtech M&A skyrockets 🚀

I did a podcast back in Feb 2022 about how common unicorns had become. There was a time you might remember — basically the whole of 2021 — when it felt like a new fintech unicorn was minted daily. Last year put the breaks on that: There was a total of just 69 total unicorn births in 2022, a 58% drop compared to 166 in 2021 (okay so it was 1 every 2 ish days… don’t be pedantic, you get the point).

Insurtech investors had a whale of a time. M&A in the space increased by 40% in 2022 to 81, up from 58 in 2021, despite a poor showing in the public markets. This makes insurtech the only fintech sector to see a year-over-year increase in M&A exits. Overall, global fintech M&A exits dipped 20% year over year to a total of 742. Additionally, fintech IPOs also decreased by 72% YoY, from 82 in 2021 to just 23 in 2022. There’s wide expectation that 2023 will see a similar uptick in M&A activity in the wider fintech market as incumbents scavenge for opportunities to scoop up deals from their distressed challengers. A nice slice of humble pie (if you call millions that) for those pesky startups with lofty ambitions of breaking the banks.

Big Banks Developing Payment Wallet to Rival Apple Pay 🍎

A group of major banks, including Wells Fargo, Bank of America, JPMorgan Chase, and four others, are collaborating to create a digital wallet for online shopping. The wallet will be linked to customers' debit and credit cards and managed by Early Warning Services LLC, the company that operates the Zelle money-transfer service.

The new wallet will be separate from Zelle, and plans to begin rolling out in the second half of the year. The goal of this new service is to compete with third-party digital wallets such as PayPal and Apple Pay, as banks seek to maintain control of their customer relationships. The banks are also looking to reduce the risk of fraud.

They expect to enable 150 million debit and credit cards for use within the wallet when it is launched, and it will be designed to roll out with cards as that is what U.S. consumers are accustomed to. The banks may also explore adding other payment options, such as direct bank account payments, if the wallet is adopted by a significant number of merchants and consumers.

The wallet will be launched with Visa and Mastercard debit and credit cards, and Early Warning Services has reached out to other card networks, including Discover Financial Services, to gauge their interest in enabling their cards to be loaded onto the wallet.

I am not even sure where to start on this one. Why are they doing it: probs because they are worried about losing customers and big time FOMO (fear of missing out).

But can big banks that routinely struggle to build half-decent digital propositions really challenge the likes of Apple and Google? These tech giants can spend billions on their tech without blinking an eye, I’m not sure banks have the budget, buy-in, or ability to compete.

Would you really want to download another app to your phone to pay with when you’ve got an integrated wallet that’s seamless, convenient, and multifunctional?

I’m not sure this is going to have legs in the long-term. But where this will get interesting is if the proposed project continues and we see a pivot at some point that focuses on these banks’ moats. Especially their ability to reach consumers, and do so physically. There’s an interesting identity verification play here that I haven’t seen being talked about that could end up being a game changer.

Another would be bank killer dies…

Looks like another crypto casualty has fallen in the wild west of digital assets. Genesis, the cryptocurrency lender, has thrown in the towel and filed for Chapter 11 bankruptcy in the US. This follows the recent collapse of crypto exchange FTX, and Genesis is the latest victim in the shakeout of the digital asset market.

The lender, Genesis Global Capital, was one of three entities that sought bankruptcy protection on Thursday. Just days before, on November 16th, Genesis had already frozen customer withdrawals, showing that the writing was on the wall. In its filing with the US bankruptcy court for the southern district of New York, Genesis stated that it had assets and liabilities in the range of $1 billion to $10 billion, and estimated it had over 100,000 creditors.

It's not just the lending arm that's feeling the heat, Genesis Global Holdco, the parent group of Genesis Global Capital, and another lending unit, Genesis Asia Pacific, also filed for bankruptcy protection. The parent company said options under consideration included a sale and that it had $150 million in cash to support the restructuring. But let's be real, that's like trying to put out a forest fire with a squirt gun.

So what does this mean for the crypto market? Honestly, I have no idea.

In other markets, you’d think this unrelenting cascade of crypto failures, steep job cuts, and loss of stakeholder would have cripple an industry beyond repair. The crypto market remains a beast without logic.

Despite the caascade of failures in the industry across last year and into this new year, cryptos appear to be resilient to negatives. In the first 25 days of this year alone Bitcoin has shot up more than 35%. LMFAO!!!

As the old saying goes, "When one door closes, another one opens". I guess in this case it's more like “when another crypto company fails, bitcoin soars”.

For now, just like a phoenix rising from the ashes, the crypto market will always find a way to come back stronger. But for how long?

Fintechs that caught my attention this week:

Kenyan fintech Kwara, which digitizes credit unions, has raised $3 million in a seed extension round, bringing the total amount raised in this funding round to $7 million. Kwara has signed a digital solutions distribution agreement with an organization representing Kenyan cooperatives and aims to fund growth with the capital raised. The company has more than doubled its client base in 2023 and hopes to deepen its relationship with the Kenyan market by investing in products and services. Kwara's app, a neobank, aims to give members of the Kenya Union of Savings & Credit Cooperatives improved access to additional services and allows for direct deposit of funds into credit union accounts. I’m telling you, don’t sleep on Africa!

Glasgow-based fintech Nude (Google at work at your own risk) is using innovative technology to help young people save for their first home through its app. The app tracks spending habits, helping users to understand how to save for a home and it raised £3.54m in a crowdfunder in 2020. The platform works on open banking standards and is connected to big banks such as Barclays and Virgin Money. The app also addresses a market need, as there has been a substantial fall in home ownership among young adults according to the Institute for Fiscal Studies. The app, which started in 2019, works by placing the amount saved each month into high-yield cash or stocks and shares ISAs, and is already helping people get on the property ladder. Here’s an interesting stat about these folks:

Monzo year 1 👉 20k users

Monzo year 2 👉 70k users

Nude year 1 👉 20k users

Nude year 2 👉 315k users