Prediction part two📅 | 🎵 Fintech ain't that easy ft. Goldman 🎵 | African fintechs get global | Meme of the week

🔮Micky 23 prediction part 2: SMBs become sexy!

Last year was the year of inflation. This year, expect that to be replaced by something more worrisome: Recession!

In the US, inflation has already peaked as a once stubbornly dovish (more like idiotic) Federal Reserve, forced to save face following a staggering misjudgment of it’s expansive monetary policy in the last few years, has taken on an equally extreme hawkish stance that has seen seven consecutive hikes that have brought the interest rate to 4.25%-4.5%. (Don’t get me started on the Fed fyi - I consider it the most authoritarian institution in the western world by a country mile. Let me know if you want a post with my thoughts on that.)

In the Eurozone and the UK the outlook is especially grim: Recession is well and truly on it’s way (despite what they may tell you) and signs of cooling prices remain tentative, despite continued attempts to grasp on to the idea that falling fuel prices will correct everything.

So what does that all mean? Feel the F’n Lag!

This year, we’ll start seeing the lag effects of these hawkish monetary policies in the form of a global economic downturn. Far from a transitory inflation, there’s wide expectation of a hard landing for economies around the world. In fact, according to Ned David Research, cited by Bloomberg, the odds of a severe global recession stand at 65%.

For a fintech industry that’s been through the wringer in 2022, the new year brings with it risks of even more pain. The heady years of 2020 and 2021 that flooded the industry with easy venture money have left many of the industry's stalwarts vulnerable to economic shocks.

For some, like pandemic darling Fast, which sped to unicorn status, it was an even quicker demise, forced to shutter early last year.

Those that survived, have had to swallow up a large slice of humble pie – some of the biggest global fintechs have been forced to raise funds at eye-watering discounts of up to 85% on their once astronomical valuation.

And with interest rates unlikely to go down anytime soon, the end of free money will see a struggle for a venture capital that’s increasingly competing with risk-free returns. Easy returns in so far as rising interest rates means govt bonds as well as lucrative yields on uber safe assets makes the search for hail mary investments in wacky startups less and less attractive.

Enter SMBs

In this new dawn, when capital is no longer free, there will be many losers. You’ve been warned. Well not you but you startups.

The winners? They’ll be focused on something we thought was relegated to the dustbin of history: business metrics. Sustainability, profitability, ebitda and all that jazz!

Here out of everything, there’s a clear market where there’s huge amounts of low hanging fruit: Small and medium sized businesses.

For years now we’ve heard the potential of fintech to ease the burdens on SMBs, from easing access to capital to digitizing their financial process and beyond. Yet, we’ve seen little progress on this front, at least when compared to the plethora of fintechs targeting retail consumers.

(Rant: Honestly one thing i’ve increasingly become aware of is just how much vacuous buzzwords and platitudes dominate the fintech industry. Shut the fack up and just do the shit homie!

I asked ChatGPT what the above means and here’s the response: This sentence expresses frustration and cynicism towards the use of empty or meaningless language in the financial technology (fintech) industry. The speaker has become aware of how often buzzwords and platitudes are used, rather than concrete ideas or action. The last phrase, "Shut the fack up and just do the shit homie" is a crude and informal way of telling someone to stop talking and start doing something useful or productive. It implies that the speaker is tired of hearing empty talk and wants to see more action in the fintech industry.)

And amid the current economic turmoil, the challenges facing SMBs are becoming further acute. In the UK for instance, more than 5,600 small businesses surveyed registered a fall in Sales in November, according to a new survey by the British Chamber of Commerce.

Given the difficult outlook, small and medium-sized businesses (SMBs) are increasingly worried about their financial performance. As revenue growth slows, cost savings and efficiency have become crucial. Large companies are also more likely to reduce their internal innovation efforts and technology investments that are not central to their business in order to focus on cost-cutting measures.

This opens the door for fintechs that can deliver real improvements to the bottom line by eliminating manual processes and saving their customers money.

For fintechs, SMBs can be a potential lifeline. Unlike retail offerings that require considerable scale to generate meaningful revenue and therefore often lead to a focus on scale rather than revenue in the early lifecycle of a fintech, SMB focused offerings have a clear revenue generating potential: Businesses are more likely to pay for products and services.

2023 will be a year when we’ll see a reversal. The shiny fintechs with an opaque path to long term sustainability will fall out of fashion as the carnage in the fintech world forces a rethink of where investor dollars end up.

Those that learn from 2022 will be those that combine their mission with a genuine plan for long-term sustainability. And nothing gets you closer to profitability than making money.

Fintechs and SMBs are natural allies. A marriage of need and convenience might be the catalyst for that real romance to blossom this year.

😬 Goldman Sachs: “It ain’t easy doin fintech”

Goldman Sachs run by one David Solomon, aka DJ D-Sol, is having a pretty shitty time as of late. Here are some of the stories of what’s going on at the investment behemoth:

It cut 3,200 jobs (last week). There’s actually an interesting piece on The Spectator about this but I didn’t post a link because the piece started talking about stock price movement after the news broke and I find that kind of journalistic take pretty useless (not that I’m not guilty of doing that). There are a multitude of reasons why stock prices move and without wider context, especially considering that it’s earning season and there’s automated stock allocations that happen at the start of a new year and during earning seasons among a number of other factors makes those takes kinda uninformative imo.

Goldman’s consumer finance division, which Solomon pushed so as to bring the bank of the rich to the mere plebs has lost $3 billion since inception. But not only that, it’s flagship offering, a credit card underwriting business with Apple (and increasingly other partners like General Motors and T-Mobile), launched with a ridiculous amount of fanfare is losing a tonne of money: It’s lost something like a $1 billion since launch. One outcome of these hefty losses is the folding of Marcus (the digital bank Goldman created) into it’s wider wealth division business.

As a sidenote for any of you budding digital bank creators, maybe don’t name your bank after a dude. As well as Marcus, JP Morgan’s Finn also saw the end of the road not too long after launch.

And this is without counting smaller controversies around the bank, including Dj D-Sol’s continued strange use of his staff to support his personal brand. Last year it was also fined $4 million for failure to follow it’s OWN ESG guideline lol.

(Lol)

While the Marcus news looks pretty bad, I actually think it’s not as bad as people have made it out too seem.

👉Yes $3 billion is a lot but at the end of the day making money and especially in financial services takes a lot of time and money, especially considering the fact that there’s a heavy technology cost associated.

👉 Successful investments require a long term vision and courage to see it through. And assessing it’s ROI, especially for a huge business like Goldman, isn’t just about looking at the balance sheet at the end of the month. For example at some point a couple of years ago Marcus had amassed in excess of $40 billion in deposits. That’s pretty nice addition to your balance sheet if your in the business of lending money. But more than that, for a company that had no real retail business, its an opportunity to create a pipeline of future consumers that generate higher than average returns. The payoff for that isn’t in the here and now but over a much longer duration. Good leaders don’t just focus on results now, they also future proof their business for a much longer view.

👉 Finally, this news is more worrying for fintechs rather than incumbents like Goldman. A big bank can brush of these losses (relatively) and has a much longer financial runway to engage in loss making activities. Fintechs, given what I said at the top, are gonna be in between a rock and a hard place: They are going to come into a time when raising money is gonna be harder than ever, but the lions share of these players have no easy route to profitability in the near to medium turn. How different fintechs squar that is going to be one of the most interesting things i’m looking forward to tracking.

🌍 African Fintechs Take Aim at Global Market (kinda)

Flutterwave, the African payments unicorn, is apparently in talks to acquire Railrs, the UK-based banking software provider.

I thought this was a pretty interesting story. Innovation in Africa is very often overlooked, despite the fact that when it comes to fintech Africa has been a major source of innovation. Think about mobile money - Kenya and the continent more widely have long been leaders in space, not that it gets reported as much.

I expect we’ll see a lot more of this. I don’t want to say much more about this story right now as I’m having a few interesting conversations next week with people embedded in the ecosystem. I’ll do a write up and include some learnings from that in the next newsletter.

Meme corner (we’re back)

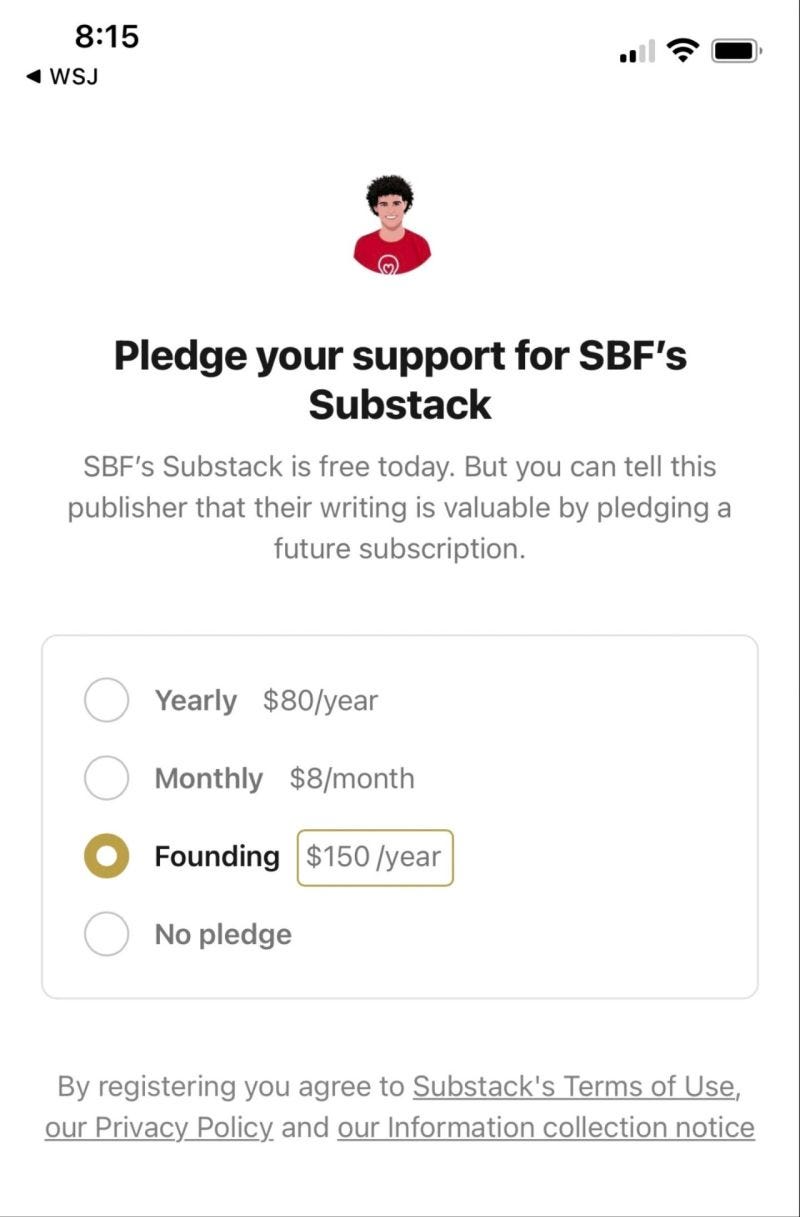

SBF got a substack. Lol.